This Information Brief examines the Affordable Care Act (the ACA)-- also known as health care reform or "ObamaCare"-- and its potential impact on substance abuse treatment. In particular, this brief considers the impact of the ACA's Medicaid expansion, Affordable Insurance Exchanges, and Essential Health Benefits (EHBs) on the healthcare market, anticipating the law's effects on the financing and provision of substance abuse treatment. The brief predicts that the influx of 27 newly insured individuals coupled with EHB and parity requirements will yield a considerable number of new substance abuse clients and trigger a notable shift in payers. These events, in turn, will drive further changes for both substance abuse treatment providers and clients, as the field moves toward new financial systems that emphasize integrated payment models.

Download the PDF: The Affordable Care Act: Shaping Substance Abuse Treatment

The Affordable Care Act: Shaping Substance Abuse Treatment

Introduction

In the wake of the 2010 Patient Protection and Affordable Care Act (ACA), American healthcare financing is at a crossroads. The ACA contains numerous provisions to reduce healthcare costs, improve quality, and expand coverage. In addition to offering states the opportunity to expand their Medicaid programs, the ACA features many chances to explore new funding mechanisms, including integrated care and payment models. If states adopt the ACA’s changes, the law will have profound effects throughout the healthcare industry. This brief considers the likely impact of the ACA on the financing and provision of substance abuse treatment. The ACA will:

- Expand the pool of individuals covered by Medicaid and private insurance;

- Expand substance abuse coverage under Medicaid and private insurance; and

- Alter the relationship between substance abuse providers, payers, and clients through care coordination, integrated care, and shared savings & risks.

Expanding Medicaid & Private Insurance

The most visible provision of the ACA is the individual mandate, which requires most Americans to obtain health insurance or pay a penalty. Coupled with the mandate, the ACA will create Affordable Insurance Marketplaces (formally Exchanges) and subsidize individual coverage purchased through those marketplaces for people earning up to 400 percent of the federal poverty level (FPL). Despite considerable variation in states’ exchange implementation, the Congressional Budget Office (CBO) estimates that marketplaces will cover 22 million people by 2022, including 15 million previously uninsured individuals and 7 million previously insured individuals expected to move to marketplace plans.

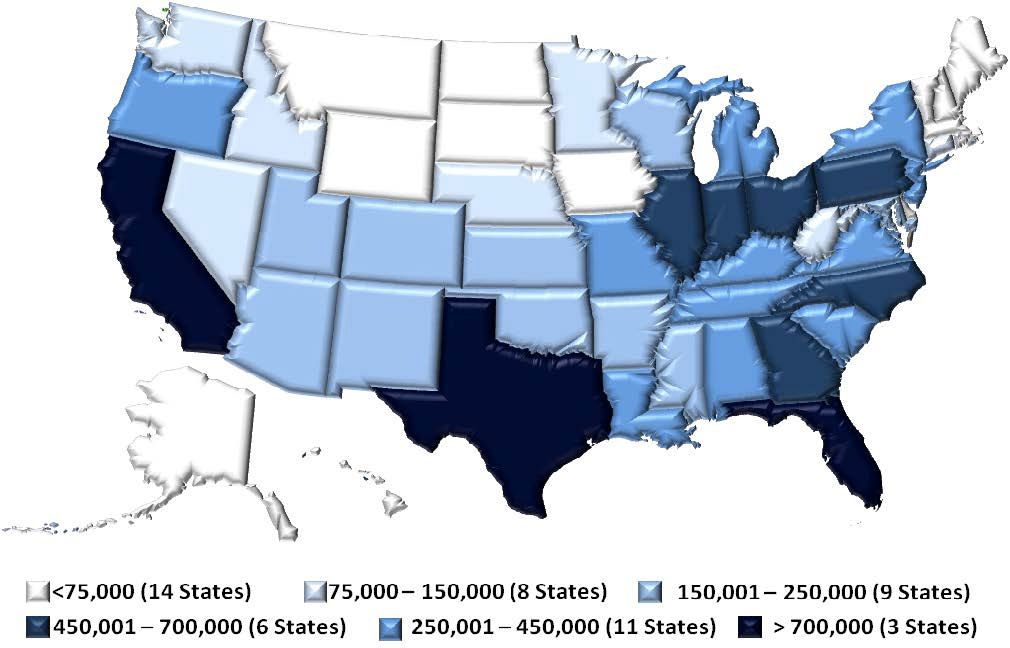

The ACA’s changes to the Medicaid system will further expand healthcare coverage. While many believe that Medicaid already provides healthcare for all low-income Americans, states are only required to cover low-income individuals in certain groups (e.g. pregnant women, parents with young children, etc.). Under the ACA, states may expand their Medicaid programs to cover all adults earning up to 138% of the FPL beginning in 2014. Because the Supreme Court rendered the expansion optional, not all states are expected to participate; however, the Federal government is set to fund most of the expansion, including 100% of the cost for newly eligible enrollees through 2016. In the states that expand, the CBO estimates that the Medicaid expansion will cover 12 million previously uninsured Americans with a highly varied impact across states. Despite limitations, the expansion could begin a shift in the U.S. healthcare system—providing public coverage based on income alone. In total, the CBO estimates that the ACA will cover 27 million previously uninsured individuals by 2022, with 15 million enrolled in marketplace insurance plans and 12 million more in Medicaid.

Shifting Substance Abuse Landscape

The ACA will also ensure that newly covered individuals receive substance abuse benefits—altering substance abuse treatment and filling the behavioral health system with new clients and payers. Beginning in 2014, the ACA establishes 10 mandatory “essential health benefits” (EHBs) for newly eligible Medicaid enrollees and most individual and small group health plans. Though states have considerable flexibility in determining the details of their EHBs, substance abuse treatment is among the required benefit categories. Furthermore, the ACA requires applicable plans to comply with the Mental Health Parity and Addiction Equity Act (MHPAEA or the “Parity Act”). According to HHS, MHPAEA and the ACA will expand behavioral health coverage for 62.5 million persons by 2020. Together, the laws will allow 32.1 million individuals to access substance abuse benefits for the first time and expand behavioral health coverage for 30.4 million individuals with existing behavioral health benefits. Notably, the scope of those benefits and the ease with which individuals may access them may vary considerably by state.

EHBs, MHPAEA, the Medicaid expansion, and Affordable Insurance Marketplaces will significantly alter substance abuse financing in ways far beyond access. In addition to the influx of newly covered individuals, the composition of payers will begin to shift as clients gain new coverage. Without accounting for the ACA, SAMHSA estimated 2014’s substance abuse spending distribution as: 17% private (7% is private insurance, 6% out-of-pocket, and 4% other private), 20% Medicaid, 14% other Federal, 45% Other State & Local, and 5% Medicare. Under the ACA, shares paid by Medicaid and private insurance will increase significantly; however, state decisions regarding Medicaid and marketplaces will yield significant interstate variation in coverage and payers.

In states that expand Medicaid, other public spending should decline as states leverage Medicaid before tapping other resources. Currently, care for low-income clients comes largely from state & local funds and the SAMHSA Block Grant—which combine to account for nearly half of substance abuse treatment expenditures. A National Association of State Alcohol and Drug Abuse Directors analysis of Maine, Massachusetts and Vermont showed that the Block Grant remained crucial even after major coverage expansions. Under the ACA, the role of the Block Grant may shift—possibly playing different roles in different states, depending on their needs.

Integrated and Accountable Care

The ACA will have a major impact on most aspects of substance abuse treatment—with clients, providers, and payers all affected by the new landscape. Clients and providers will face new systems of care as new payers seek innovative ways to provide high-quality, low-cost care. Though the details of these arrangements will vary, they will likely focus on integrated and coordinated care, creating provider networks and often leveraging bundled or outcome-oriented payments to ensure accountability.

The ACA does not require care integration but it includes numerous provisions to encourage it—laying the framework for accountable care organizations (ACOs), patient-center medical homes (PCMHs), and Medicaid health homes. With an influx of new enrollees, provider networks will likely seek partnerships with substance abuse providers to provide low-cost integrated care. Clients will realize new opportunities to access substance abuse treatment; however, treatment may be delivered by a changing set of providers, dictated by new payment mechanisms, governed by new coverage guidelines, and funded by new payers.

Like their clients, substance abuse treatment providers will face new conditions, including larger client volume and shifting payers. Private insurers, Medicaid, and the new environment fostered by the ACA will likely emphasize coordinated, integrated, and cost-minimizing approaches to healthcare. These new approaches will require new partnerships and new business skills, geared more toward Medicaid and private insurance than ever before. Because substance abuse providers were often carved out of previous payment reforms like health maintenance organizations (HMOs), these changes may affect them more than other providers. Substance abuse providers may face significant challenges adjusting to new care coordination and payment schemes, shared risk/savings models, and new reimbursement policies.

Early Examples in Medicaid

Though no one can predict the exact nature of the new payment systems, Medicaid programs in Oregon and Massachusetts may provide a glimpse of possible changes. To better integrate healthcare, Oregon’s Medicaid Section 1115 Research and Demonstration waiver will transform the state’s Medicaid program to a managed care model, featuring coordinated care organizations (CCOs). Through CCOs, substance abuse providers will share a treatment budget with other providers to deliver holistic care. Similarly, as part of a Massachusetts law, all state-funded health plans will transition to a global payment system. Under the new system, provider networks will receive a single annual per-patient fee to cover all of an individual’s healthcare needs, with unused funds dictating profit. Illustrating the complexities unique to behavioral health, the Massachusetts law creates a commission to ensure that behavioral health providers are included in the new payment system. Observing these changes may offer clues about opportunities and barriers to come.

Conclusion

The ACA will significantly alter the behavioral health landscape, affecting clients, providers, and payers for years to come. Although it is too early to predict the exact impact of the confluence of Medicaid expansions, Affordable Insurance Marketplaces, EHBs, care integration, MHPAEA, and accountable payment systems, providers will surely face new clients, a notable shift in payers, and changing financing schemes. With Medicaid and private insurance set to take on larger roles, providers and clients will face serious challenges and profound opportunities.